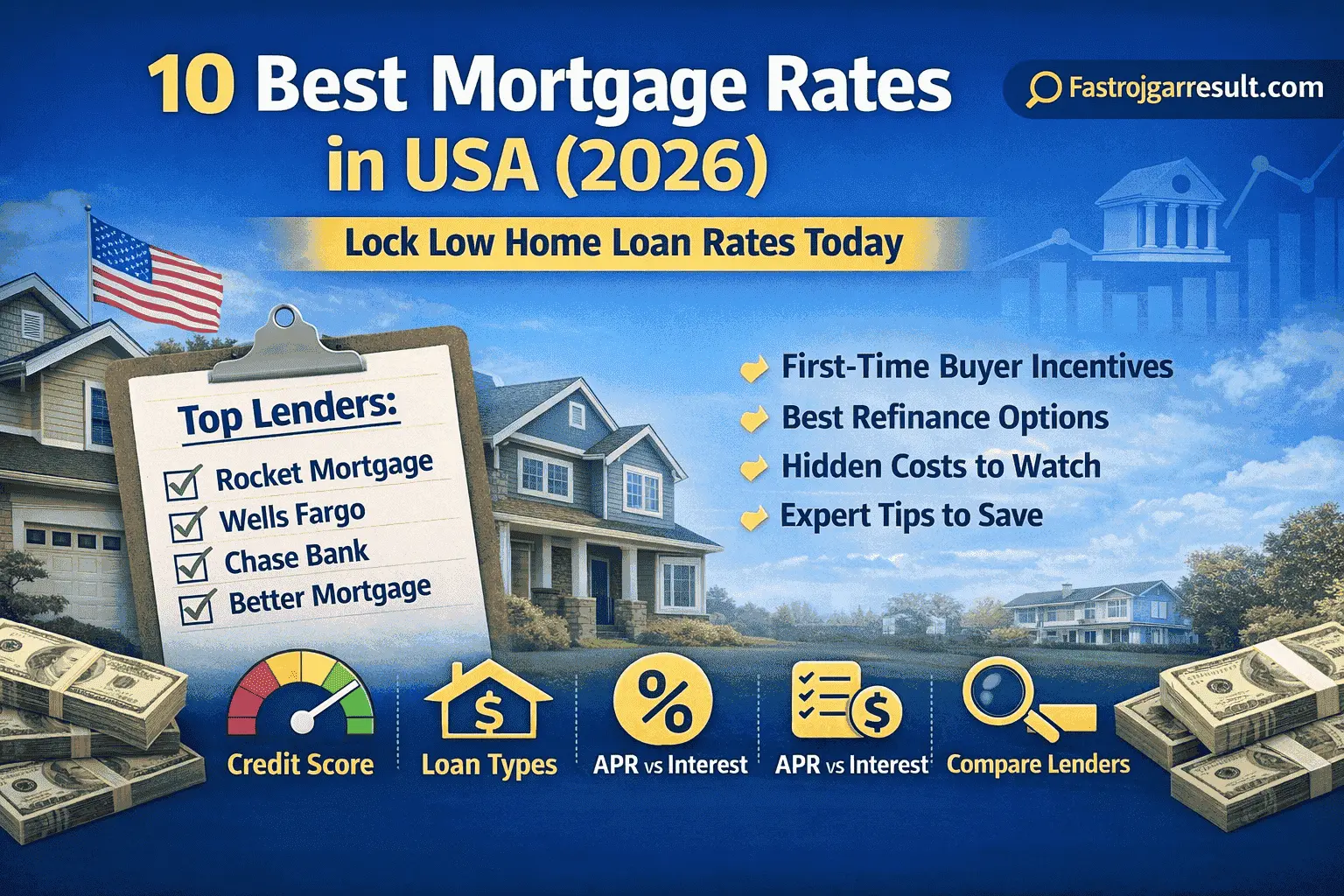

Best Mortgage Rates in USA – Complete 2026 Home Buyer’s Guide

Best mortgage rates in USA play a massive role in deciding how much you actually pay for your home over 20–30 years. Even a small difference of 0.5% in mortgage rates can save or cost you tens of thousands of dollars in the long run.

This complete 2026 guide explains the best mortgage rates in USA, top lenders, loan types, and expert strategies to secure the lowest possible home loan rate.

What Are Mortgage Rates in USA?

Mortgage rates in the USA refer to the interest charged by lenders on home loans. These rates determine your monthly EMI and total loan cost.

The best mortgage rates in USA usually offer:

- Low interest rates

- Stable monthly payments

- Flexible loan terms

- Transparent fees

Mortgage rates depend on market conditions, inflation, and your credit profile.

Why Choosing the Best Mortgage Rates in USA Matters in 2026

In 2026, selecting the best mortgage rates in USA is more important than ever because:

- Home prices remain high

- Interest rate fluctuations are common

- Long loan terms amplify small rate differences

- Bad mortgage choices lead to lifelong financial stress

A smart mortgage decision can save you $50,000–$150,000+ over time.

Types of Mortgage Loans in USA

Understanding loan types helps you choose the best mortgage rate in USA.

Fixed-Rate Mortgage

Same interest rate for the entire loan term (15 or 30 years).

Adjustable-Rate Mortgage (ARM)

Lower initial rate that changes later based on market rates.

FHA Loans

Government-backed loans with lower down payment requirements.

VA Loans

Exclusive for veterans with zero or low down payment.

Jumbo Loans

For high-value properties above standard limits.

9 Best Mortgage Rates in USA (2026 Updated List)

1. Rocket Mortgage

One of the most popular online mortgage lenders.

Why it offers some of the best mortgage rates in USA:

- Competitive rates

- Fast digital approval

- Transparent process

2. Wells Fargo Home Loans

Trusted traditional lender.

Key benefits:

- Strong refinancing options

- Nationwide availability

- Multiple loan programs

3. Chase Home Lending

Ideal for borrowers with strong credit.

Highlights:

- Competitive fixed-rate mortgages

- First-time buyer programs

- Relationship discounts

4. Bank of America Mortgage

Best for bundled banking benefits.

Why choose it:

- Rate discounts for existing customers

- Low down payment options

- Flexible refinancing

5. Better Mortgage

Fully digital mortgage experience.

Top features:

- No lender fees

- Fast pre-approval

- Transparent pricing

6. Navy Federal Credit Union

Excellent for military families.

Best for:

- Low interest VA loans

- Minimal fees

- Member-focused service

7. Quicken Loans (Rocket)

Best for speed and convenience.

Why it stands out:

- Quick approvals

- Strong customer support

- Easy online tools

8. LoanDepot

Good for refinancing.

Benefits:

- Competitive refinance rates

- Streamlined application

- Flexible terms

9. U.S. Bank Mortgage

Reliable and stable lender.

Why it’s trusted:

- Fixed and ARM options

- Strong financial backing

- Local branch support

Best Mortgage Rates in USA for First-Time Buyers

First-time buyers should look for:

- FHA loans

- Low down payment programs

- First-time buyer grants

Lenders like Bank of America and Chase often provide special incentives.

Best Mortgage Rates in USA for Refinancing

For refinancing in 2026, the best mortgage rates in USA are offered by:

- Rocket Mortgage

- LoanDepot

- Wells Fargo

Refinancing can reduce EMIs or shorten loan tenure.

How to Choose the Best Mortgage Rate in USA (2026)

To select the best mortgage rates in USA, consider:

Credit Score

Higher score = lower interest rate.

Loan Term

15-year loans have lower rates than 30-year loans.

Down Payment

Higher down payment reduces risk and interest.

APR vs Interest Rate

APR shows the real cost including fees.

Mortgage Interest Rates, Fees & Hidden Costs

Even the best mortgage rates in USA include extra costs:

- Origination fees

- Closing costs

- Private Mortgage Insurance (PMI)

- Property taxes & insurance

Always calculate the total loan cost, not just EMI.

Common Mortgage Mistakes to Avoid

Avoid these costly mistakes:

- Not comparing lenders

- Ignoring APR

- Choosing wrong loan type

- Overstretching budget

- Skipping pre-approval

Expert Tips to Get the Lowest Mortgage Rate in 2026

Get the best mortgage rates in USA by:

- Improving credit score

- Paying larger down payment

- Locking rates at right time

- Comparing at least 3 lenders

- Negotiating lender fees

🔥 Affiliate CTA (High Conversion – 2026)

✅ Check the Best Mortgage Rates for 2026

Planning to buy or refinance a home? Compare top mortgage lenders and lock the lowest home loan rates available today.

👉 Get Your Free Mortgage Rate Quote Now

External DoFollow Resources

- Home Loan Basics: https://www.usa.gov/mortgages

- Consumer Mortgage Guide: https://www.consumerfinance.gov

Final Verdict: Best Mortgage Rates in USA (2026)

Choosing the best mortgage rates in USA in 2026 can be one of the most important financial decisions of your life. The right lender and rate can save you massive amounts of money while keeping your finances stress-free.

Take your time, compare smartly, and lock your rate wisely